I am a strategy, finance and corporate development professional with 15+ years of experience

Strategic Finance

One of the great benefits of working for a large company such as General Motors was an opportunity to work in different roles. There was a large internal job market that favored current employees. Initially, I worked on partnerships such as development on the next generation of transmission with Ford and strategic investment into Lyft. I took the role of a finance lead for the newly formed Maven Car Share. I developed business cases and launch plans as a first step. Then I created a budget to make sure that sufficient resources were available to start offering the car sharing services. As part of the launch, I implemented financial systems that allowed us to receive payments and generate financial reports. Lastly, I analyzed the financial reports and created management discussion and analysis around them.

My last role at General Motors was in the OnStar division that is an early pioneer in connected car services. It traditionally provided services such as automatic crash response and my team of 3 financial analysts created business cases for new services such as driver behavior scoring and creating an app with discounts and offerings.

Most recently in my career, I have been a VP of Finance at a late-stage healthcare technology start-up Sypase where I was responsible for Financial Planning and Analysis, capital raising and restructuring. My accomplishments include the following

• Implemented a cost-saving program that reduced the operating expense by $15 million

• Raised $35 million growth funding round amid challenging market conditions

• Rebuilt financial planning, analysis (FP&A), budgeting, modelling, and forecasting function

Corporate Development

After working for large corporations, I accepted an invitation to join a portfolio company of a private equity firm Abry Partners. My mandate was to grow the company through acquisitions and get it ready for sale to the next owner. I directed all financial and diligence aspects of acquisitions with deal size $20+ million that significantly expanded the business mix. I also played a critical role in negotiating the target price and acquisition terms.

As one of only 3 Chief Executives, I presented financials and business cases to the board of directors and participated in every board meeting. I also conducted a number of strategic studies and managed strategic alternative review of an unprofitable business segment. My aggressive restructuring effort resulted in $2 million cost saving and boosted efficiencies by refocusing on the profitable sales channels.

Toward the end of my term at Smart Start I led an attempted sale process of Smart Start alongside two investment banks. This involved creating a 5-year acquisition model and developing a management presentation for the corporate sale. I also participated in management presentations and led due diligence with several prospective buyers while collaborating with bankers.

The prior step in my career journey was at AAA Northern California, Nevada and Utah. The geographical description is important because AAA is a collection of regional automobile clubs with significant degree of independence.

Our regional headquarters were in San Francisco Bay Area and we led the other clubs in innovation due to the proximity to the Silicon Valley. For example, we established an innovation lab called A3 Ventures. One of the first and most important projects to come out of the lab was GIG Car Share which I helped set up. I also developed strategy papers for other ventures involving autonomous vehicles, financial services and auto repair.

Mergers and Acquisitions

My investment banking career began in 2006 with a culture shock. I got hired from MBA program however I did not fully anticipate the demands of the job. Every banker played a specific role on the transaction team. Analysts were responsible for research, comps, precedents and PowerPoint presentations. Associates were pulling together valuations. Vice Presidents managed transaction processes. Directors and Managing Directors oversaw deals and helped with transaction origination.

I started as a mergers and acquisitions (M&A) associate. Initially, I was responsible for valuations and financial modelling. I went through a rigorous investment banking training which benefits be to this day in my academic and professional pursuits.

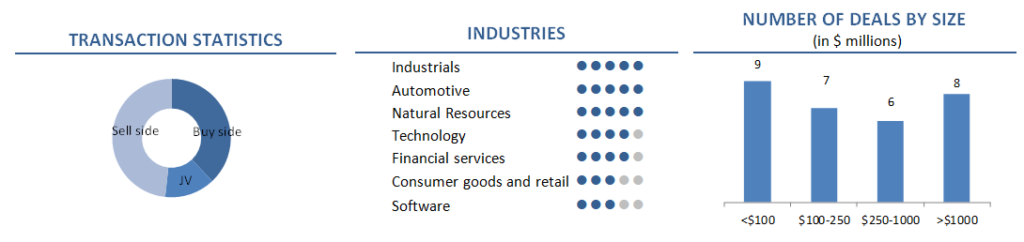

I was promoted to a Vice President in 2010 and continued in M&A group for 7 years. My role as a VP has changed from analytics to project management. I completed 30 M&A deals valued at $70 billion. Above are some statistics on my deals in 2006-2013.